Option straddle calculator

Build option strategies in real-time with our options profit calculator and visualizer. This is part 4 of the Option Payoff Excel TutorialIn the previous parts first second third we have created a spreadsheet that calculates profit or loss for a single call or put option given the strike price initial option price and underlying priceNow we are going to expand it to also work with positions involving multiple options strategies such as straddles condors butterflies.

Option Straddle Strategies Explained Youtube

Take the hard work out of finding the right option with our Option Finder.

:max_bytes(150000):strip_icc()/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

. Best Stocks For Iron Condors Put Option Profit Calculator. 5 Things to Know Before You Start Options Trading. This is the Excel in which your options trades will be.

Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. Option Alpha Review Long Straddle vs Long Strangle AAPL and SPY Examples Option Buying Power Explained. A realtime options profit calculator that expands and teaches you.

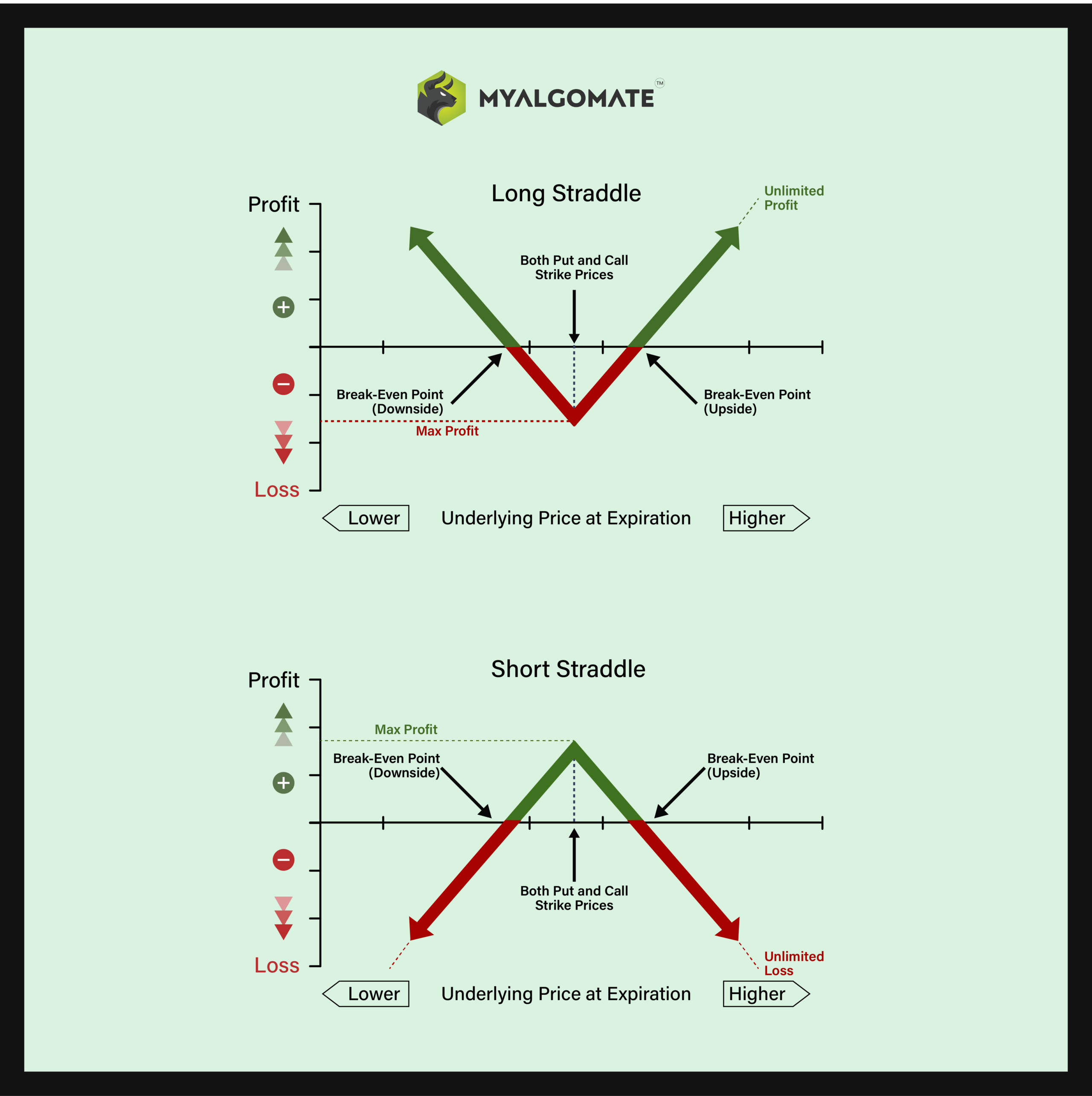

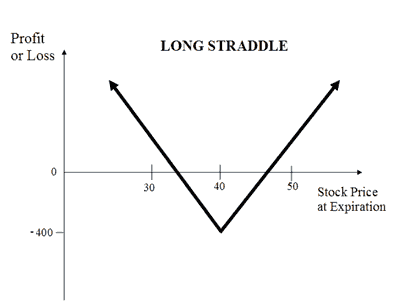

Use the Probability Calculator to verify that both the call and put you sell are about one standard deviation out-of-the-money. The Advanced Options Calculator is composed of several files. This approach may be used when an investor is unsure which way prices for the underlying asset are likely to move.

We know real money Holdem is exciting and rewarding so weve reviewed the best online poker rooms sourced the top bonuses and looked into every game type so you dont have to. Use the Probability Calculator to help you form an opinion on your options chances of. Reposition any trade in realtime.

Examine the stocks Volatility Charts. 10 Tips For Option Trading Success Everything You Need To Know About Options Bid Ask Spread IV Rank vs IV Percentile. Enter the price you expect the stock to move to by a particular date and the Option Finder will suggest the best call or put option to maximise profit at the expected price-point.

Underneath the main pricing outputs is a section for calculating the implied volatility for the same call and put option. The option you sold will increase in value bad but it will also increase the value of the option you bought good. Create Analyze options strategies view options strategy PL graph online and 100 free.

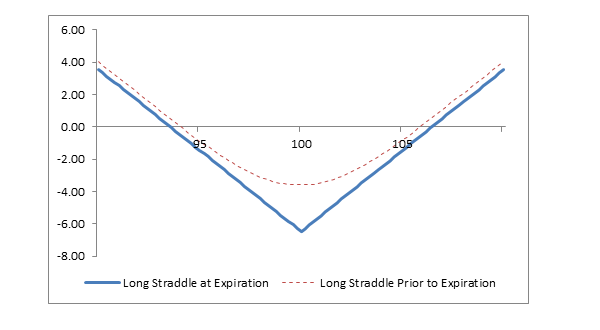

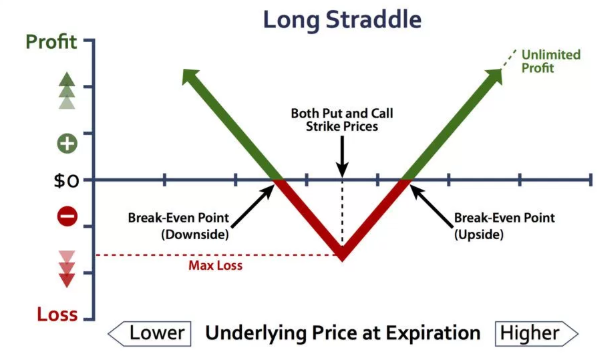

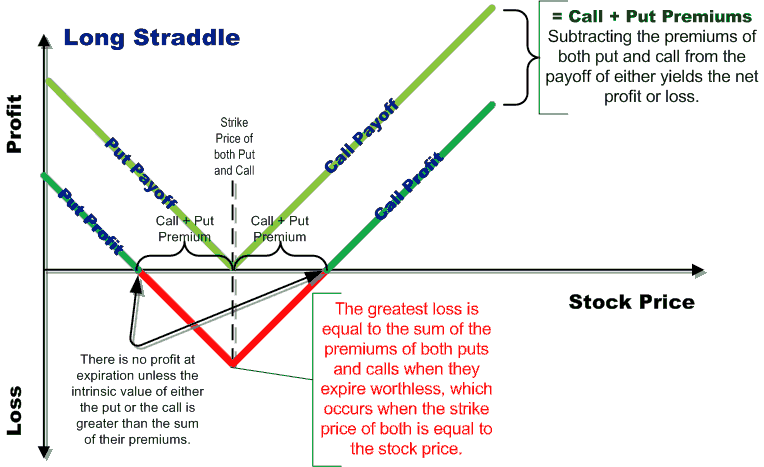

What does the Advanced Options Trading Calculator include. Iron Condor Calculator shows projected profit and loss over time. A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time.

When the strike price of an option is lower than the current market price of an underlying. Option Trading is a broader term used in the investment sector just like equity commodity currency etc. Packer Specs PDF Packer Inflation Pressure Formula Calculator Excel Technical Papers.

No more scrolling through lengthy option chains just select a stock expiration date and strikes to see stats about your trade including. In the Strike column you can check the strike price of a particular stock. The Profit at expiry is the value less the premium initially paid for the option.

Play fast-paced high drama Texas Holdem for real money at the best poker sites online. It will likely enhance your trading in a tangible way. However its different from other segments since its a kind of contract that gives a right but not an obligation to the buyer and seller to execute the trading deal within the timeframe or validity of the contract and at a fixed price.

You can literally visualize simulate and theorize about every trade possible. Check your strategy with Ally Invest tools. If out-of-the-money options are cheap theyre usually cheap for a reason.

Options Strategy Builder - Column Reference. Poor Mans Covered Call calculator addedPMCC Calculator. Let us now use the option calculator to calculate the volatility of the underlying.

A simple long straddle. Python quantitative trading strategies including VIX. In the call LTP column you can get the data on the last traded price of the call option.

Support for Canadian MX options Read more. IV is now based on the stocks market-hours. The cost of the trade or the credit received Maximum potential profit and loss.

Check your strategy with Ally Invest tools Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze the Option Greeks. To do this I leave the. If you already bought an option and want to see what the profit and loss looks like for your specific position you can input the purchase price of the option.

So far we have assumed that you are currently opening a new trade using the current option prices. This is the Excel of the current version that will allow you to create all the options strategies where you will analyze simulate and adjust your trade. An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

Which Should You Use. An iron condor is a four-legged strategy that provides a profit plateau between the two inner legs. When an option expires you have no longer any right in the contract.

Option expires Out of the Money. The option calculator uses a mathematical formula called the Black-Scholes options pricing formula also popularly called the Black-Scholes Option Pricing Model. Here you enter the market prices for the options either last paid or bidask into the white Market Price cell and the spreadsheet will calculate the volatility that the model would have used to generate a theoretical price that is in-line with the.

Python quantitative trading strategies including VIX Calculator Pattern Recognition Commodity Trading Advisor Monte Carlo Options Straddle Shooting Star London Breakout Heikin-Ashi Pair Trading RSI Bollinger Bands Parabolic SAR Dual Thrust Awesome MACD - GitHub - je-suis-tmquant-trading. Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze the Option Greeks. The calculator works in all versions of Excel from Excel 97 to the latest also including Office 365 and Excel for Mac.

A powerful options calculator and visualizer. Value stock price - strike. Lets you calculate option prices and view the binomial tree structure used in the calculation.

You can easily sort the Strike data from highest to lowest and. Maximum risk is limited. Binomial tree graphical option calculator.

Profit value at expiry - option cost number of contracts 100 _____ stock price - strike - option cost _____ number of contracts 100. To enter the purchase price simply click on the option to open the option menu. Play Texas Holdem Poker Online.

Either the original Cox Ross Rubinstein binomial tree can be selected or the equal probabilities tree. The default version is a standard macro-enabled xlsm file but there is also a xls for older Excel versions and xlsx version if you cant or dont want to use macros. Soil Vapor Extraction SVE Well Heads.

Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze the Option Greeks. Check your strategy with Ally Invest tools. This approach basically calculates prices for nodes which straddle the specified.

Option Calculator to calculate volatility. When the strike price of an option is higher than the current market price of an underlying security It is OTM for the call option holder. Cash Secured Put calculator addedCSP Calculator.

Here you can get to know about all the columns present in the options strategy builder feature.

Options Straddle Strategy Short Straddle Vs Long Straddle Myalgomate

Long Straddle Option Strategy Guide Example

Long Straddle Option Strategy Guide Example

Long Straddle Options Strategy Fidelity

Short Straddle Option Strategy The Options Playbook

Straddles And Strangles Non Directional Option Strategies

Long Straddle Option Strategy Download Scientific Diagram

Straddle Option Strategy Everything You Need To Know The Options Bro

/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

Long Straddle Definition

Options To The Rescue Of Risk Sensitive Investors How I Use Long Straddles To Profit From Volatility Seeking Alpha

/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

Long Straddle Definition

:max_bytes(150000):strip_icc()/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

Long Straddle Definition

Long Straddle Volatile Options Trading Strategy Suitable For Beginners

Long Call Synthetic Straddle Explained Online Option Trading Guide

Long Straddle Buy Straddle Option Strategy Explained

Long Straddle Option Strategy The Options Playbook

Execute The Option Straddle Long Straddle Option Strategy The Options Manual